- November 25, 2024

- Posted by: ISSLServ

- Category: Uncategorized

Cryptocurrency trading platform

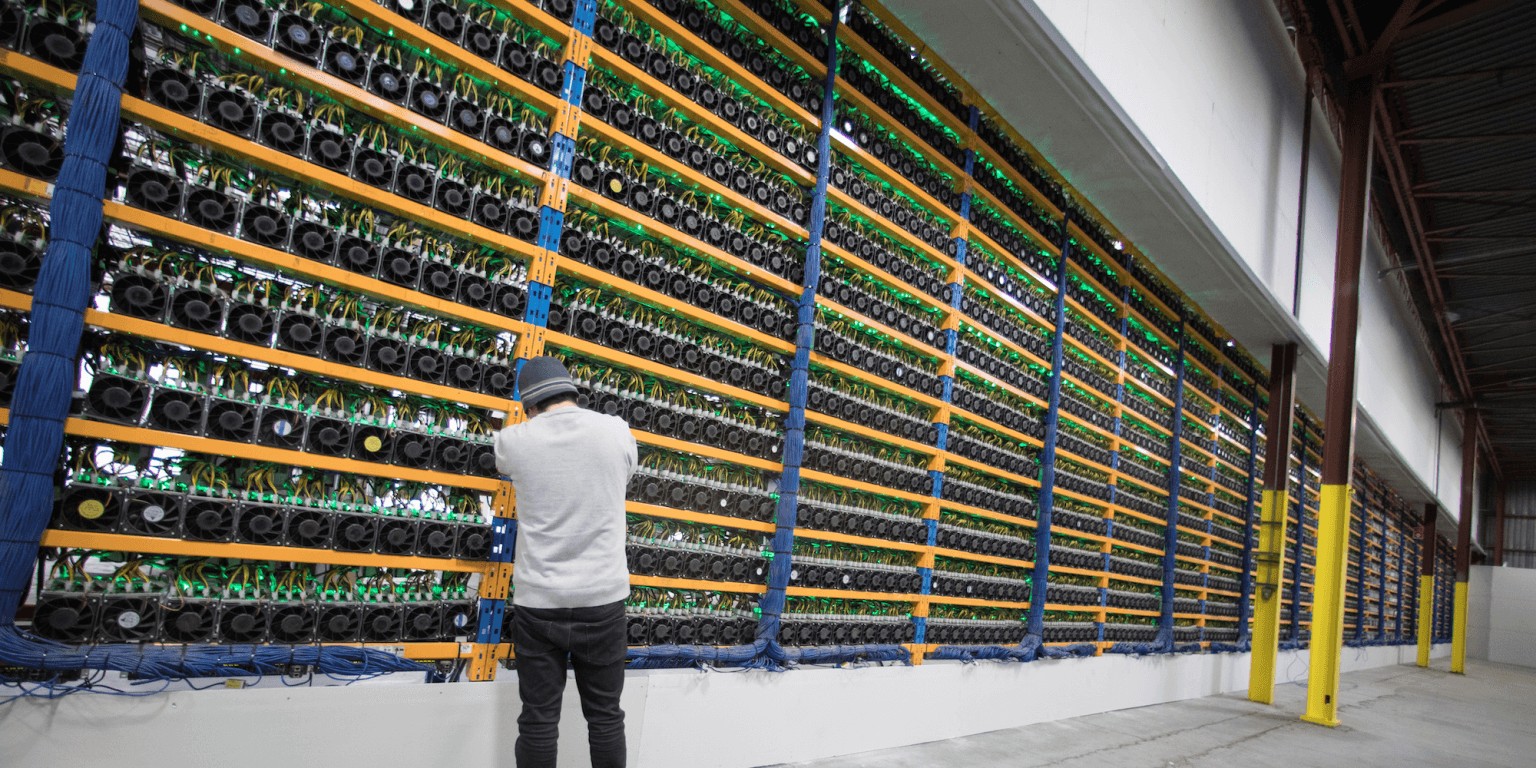

All mined cryptocurrencies use the proof of work consensus model to verify their miners and protect the network from attacks. Bitcoin, Ether, Litecoin, Bitcoin Cash, Monero, and Dogecoin require mining to make new coins. 1feexv6bahb8ybzjqqmjjrccrhgw9sb6uf Mining rigs are the units used for performing mining, and they vary in scale, performance, size, efficiency, and price. Besides this, miners consider hash rate, energy usage, and adaptability when selecting a rig.

Once a node verifies a transaction, it places it in a “pending” state. Crypto miners then place these pending transactions into unconfirmed blocks. This block traverses the network across all nodes to validate itself as following the rules of that network, after which it attaches to the previous block, forming the blockchain.

You need no specific qualifications to become a crypto miner but must meet minimum hardware requirements to join a mining pool. Each pool has its minimum requirements, so check with the pools you want to join to see if your mining right meets the minimum requirements. Pools typically require you to have a GPU or ASIC system.

With your crypto mining rig installed and a good understanding of blockchain and mining, it’s time to start mining. However, you must first choose the free mining software or app you’ll use. Your choice will depend on how you plan on mining.

Cryptocurrency bitcoin

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex and difficult to track.

On 25 March 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes. Therefore, virtual currencies are considered commodities subject to capital gains tax.

According to Bloomberg and the New York Times, Federation Tower, a two skyscraper complex in the heart of Moscow City, is home to many cryptocurrency businesses under suspicion of facilitating extensive money laundering, including accepting illicit cryptocurrency funds obtained through scams, darknet markets, and ransomware. Notable businesses include Garantex, Eggchange, Cashbank, Buy-Bitcoin, Tetchange, Bitzlato, and Suex, which was sanctioned by the U.S. in 2021. Bitzlato founder and owner Anatoly Legkodymov was arrested following money-laundering charges by the United States Department of Justice.

In May 2020, the Joint Working Group on interVASP Messaging Standards published “IVMS 101”, a universal common language for communication of required originator and beneficiary information between VASPs. The FATF and financial regulators were informed as the data model was developed.

The increase in competition between miners for new Bitcoins has seen large increases in the amount of computing power and electricity required (which is often used for air conditioning to cool computer systems). While it is difficult to calculate with precision, some estimates suggest that the annual energy consumption of the Bitcoin system is roughly equal to the country of Thailand.

Cryptocurrency wallet

In contrast to simple cryptocurrency wallets requiring just one party to sign a transaction, multi-sig wallets require multiple parties to sign a transaction. Multisignature wallets are designed for increased security. Usually, a multisignature algorithm produces a joint signature that is more compact than a collection of distinct signatures from all users.

Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password, using two-factor authentication for exchanges, and storing any large amounts you have offline.

A number of technologies known as wallets exist that store the key value pair of private and public key known as wallets. A wallet hosts the details of the key pair making cryptocurrency transactions possible. Multiple methods exist for storing keys or seeds in a wallet.

A brainwallet or brain wallet is a type of wallet in which one memorizes a passcode (a private key or seed phrase). Brainwallets may be attractive due to plausible deniability or protection against governmental seizure, but are vulnerable to password guessing (especially large-scale offline guessing). Several hundred brainwallets exist on the Bitcoin blockchain, but most of them have been drained, sometimes repeatedly.

In contrast to simple cryptocurrency wallets requiring just one party to sign a transaction, multi-sig wallets require multiple parties to sign a transaction. Multisignature wallets are designed for increased security. Usually, a multisignature algorithm produces a joint signature that is more compact than a collection of distinct signatures from all users.

Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password, using two-factor authentication for exchanges, and storing any large amounts you have offline.

Cryptocurrency meaning pi

The Pi Network, developed by a team of Stanford University graduates, enables users to mine PI cryptocurrency coins using desktop and mobile phone apps, validating transactions on a distributed record.

The Global Consensus Value represents a fascinating case study in collective wishful thinking. Some community members advocate for a per-coin valuation of $314,159 — a figure entirely disconnected from the project’s official stance and one that would make cryptocurrency veterans choke on their coffee.

While the community-driven GCV narrative captivates imaginations, it represents dangerous financial fantasy. With a total supply of 100 billion Pi, this community-proposed valuation becomes even more detached from reality, suggesting a market cap that would dwarf the entire global economy several times over.

To start mining PI, users must download the Pi Network app and sign up using an invitation code, usually received from the person who referred them. The Pi mining app doesn’t need to stay open for the mining to occur. Users must check in every 24 hours and hit the lightning button to boost their mining rate. The mining rate is also boosted by referring other users with your referral code, reflecting Pi Network’s emphasis on expanding its user base.

She also said that the app is based on “very nascent and experimental technology”.She added: “Despite high claims, there is no assurance that this network will have a future, and it is much too early to know whether the coins acquired will be worth anything.”