- January 18, 2024

- Posted by: ISSLServ

- Category: Bookkeeping

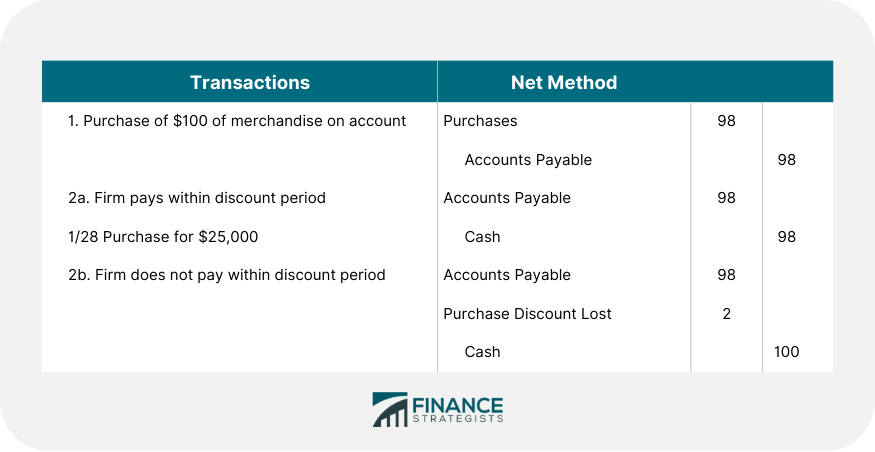

You can use gross and net revenue during financial planning to make smart decisions, set achievable goals, and ensure long-term business success. By using a CRM, you can streamline financial planning and quickly get a clear picture of your current and predicted financial situation. For example, a CRM can use your gross and net revenue to predict forecasted sales for the next quarter based on past results. Additionally, your CRM can help you manage your cash flow, especially in terms of the impact that expenses have on your revenue. This means that the purchase amount will be reduced by the value of any discounts and only the net total (after taking into account discounts) will be recorded in accounts payable.

FAR CPA Practice Questions: Journal Entries for Treasury Stock Transactions

Additionally, the net method can simplify financial analysis by presenting a cleaner, more streamlined view of revenue and expenses, which can be easier to interpret for stakeholders. However, if the invoice is not paid within the discount period, an adjusting entry needs to be made under the net method in order to recognize the loss on the discount. By recording this adjustment, the accounts payable need to be adjusted back to the full invoice amount. By using both gross and net revenue, your business can approach financial planning from a balanced perspective. Gross revenue helps you understand the organization’s scale and potential, while net revenue ensures plans are realistic, reflecting actual income for growth, cost management, and profitability.

Under Perpetual Inventory System

If the discount is availed, the journal entry is to debit accounts payable for the net price and credit cash. After that, it depends on whether the payment is made within the discount period or after. If discount opportunity is missed, the journal entry is made for the full payment as usual.

What is the impact of the gross method of recording purchase discounts on financial statements?

Learn the definition of a cash discount along with the formula to calculate it, and follow the examples to practice calculating a cash discount. When the discount is not taken, “Sales Discount Forfeited” or “Purchase Discount Lost” is recognized. The net method requires companies to record the discounted amount as their cost of goods sold, while with the gross method, they record the total invoice amount before applying any discounts. This means that if there is an audit, it will be difficult to prove that the discounts have been properly accounted for and recorded. Additionally, it may result in overstating profits by not recognizing any purchase discounts at the time of payment. The same as the perpetual inventory system, there is a journal entry needed under the gross method to record the adjustment of discount lost.

Sign up for the Salesblazer Highlights newsletter to get the latest sales news, insights, and best practices selected just for you. Based in Greenville SC, Eric Bank has been writing business-related articles since 1985. Accountingverse is your prime source of expertly curated information for all things accounting.

Amount at which sales are recorded

On the liabilities side, accounts payable will show the full amount owed to suppliers, offering insights into the company’s procurement and payment processes. These detailed records can help stakeholders evaluate the company’s financial stability and operational effectiveness. The Purchases account is usually grouped with the income statement expense accounts in the chart of accounts. Any amount recorded in Purchase Discounts Lost informs management that its policy of paying within the discount period has been violated. The gross method of accounting stands in contrast to the net method by recording transactions at their full invoice value, without initially considering any potential discounts. This approach can lead to a more straightforward recording process, as it does not require the anticipation of discounts at the time of the transaction.

By recording transactions at their full value, this method ensures that the financial statements reflect the total economic activity of the business. This comprehensive recording can lead to higher reported revenues and expenses, which in turn affects key financial metrics such as gross profit, operating income, and net income. Gross method accounting revolves around the principle of recording transactions at their full value before any deductions or allowances are applied. This approach ensures that the initial transaction amounts are fully transparent, providing a clear picture of the company’s gross revenue and expenses. By capturing the total value of sales and purchases, businesses can better track their financial activities and understand the true scale of their operations.

International shipments typically use “FOB” as defined by the Incoterm standards, where it always stands for “Free On Board”. Or Canada often use a different meaning, specific to North America, which is inconsistent with the Incoterm standards. In merchandising accounting, purchases are the amount of goods a company buys in the course of a year, including the kind, quality, quantity, and cost. This approach can significantly impact how companies report their finances, offering potential benefits in terms of accuracy and clarity. Understanding its concepts, calculations, and applications is essential for businesses aiming to optimize their financial reporting practices. Review what sales commission is and understand the percentage of sales method, the stair step structure, and the fixed commission structure.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Please watch the video explanation for a full understanding of the differences between the two methods. Ultimately, it’s up to you to decide which one makes the most sense for your business. Learn new skills, connect with peers, and grow your career with thousands of sales professionals from around the world.

- In both cases, the accounts receivable subsidiary ledger is updated, but not inventory, because we don’t do that under the periodic method.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Keep reading to learn more about each accounting method and how to choose the right one for your business.

- Merchandise may need to be returned for a variety of reasons, including defects, damages or wrong sizes.

This alignment helps in better matching revenues with expenses, a fundamental principle of accrual accounting. It also aids in more accurate profit margin calculations, as the recorded revenues and costs are closer to the actual amounts that will be realized. This can be particularly beneficial irs to highlight tax reform changes affecting small businesses for businesses with tight profit margins, where even small discrepancies can have significant impacts on financial performance. The net method of accounting can significantly influence a company’s financial statements, offering a more precise representation of its financial health.